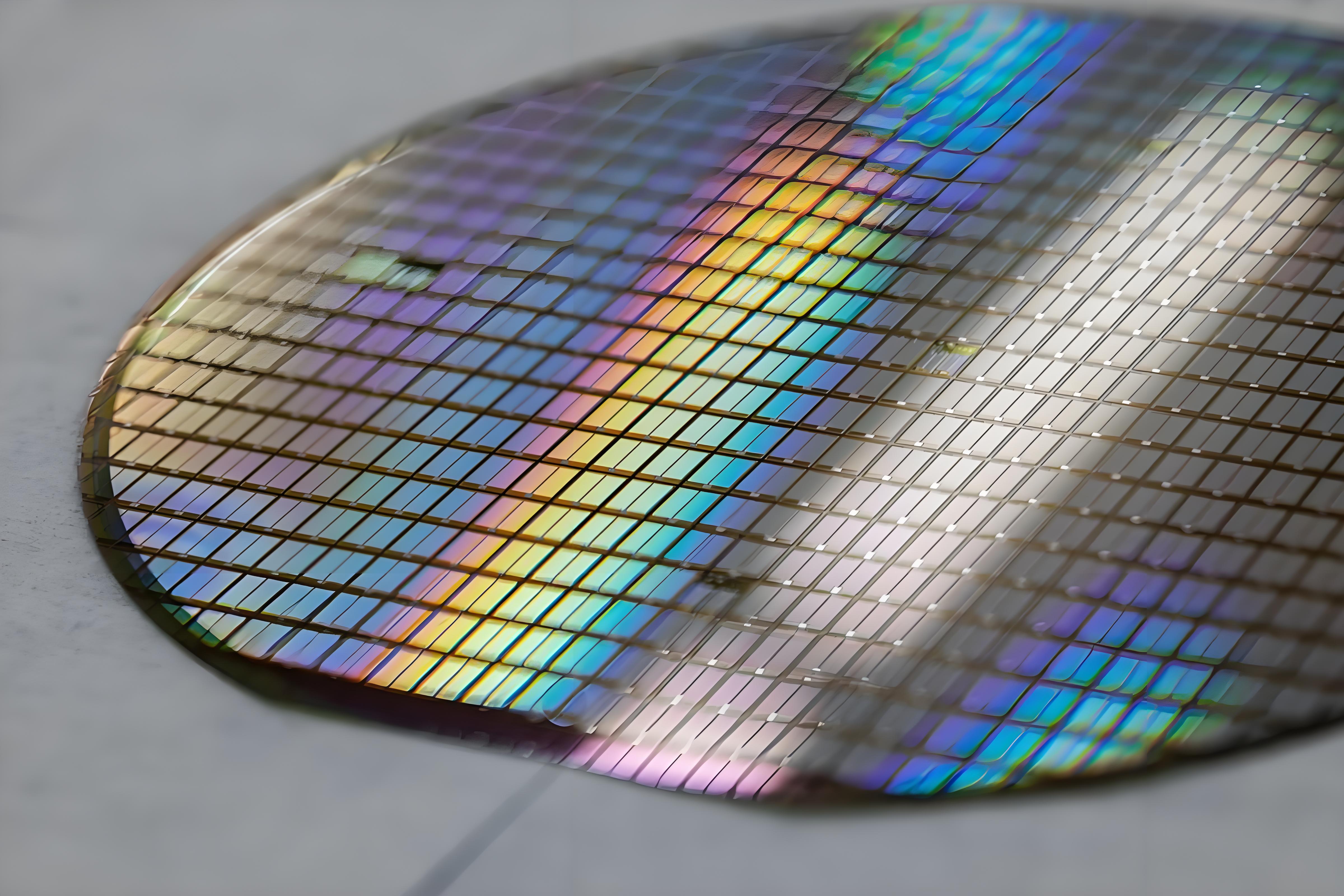

In recent years, with the rapid development of new energy vehicles and 5G communication technology, the demand for high-performance semiconductor materials has been growing. In the past year, the domestic silicon carbide industry has experienced rapid development. From the recently held 2024 wide bandgap semiconductor advanced technology innovation and application development Summit Forum, the reporter was informed that in 2023 China's silicon carbide substrate material equivalent to 6-inch wafers, shipments have reached 894,000 pieces, a surge of 297.9% compared to 2022. It is estimated that China's silicon carbide substrate production capacity in 2023 has accounted for 42% of the global capacity, and it is expected that by 2026 China's silicon carbide substrate production capacity will reach 50% of the global capacity.

Silicon carbide (SiC) substrate, as the core of the third generation semiconductor material, has attracted much attention because of its excellent performance in high frequency, high temperature and high pressure environment. However, the global production of silicon carbide substrate has long been subject to factors such as slow growth rate and complex process, resulting in limited production capacity. Recently, with the large-scale expansion of core suppliers such as Cree (now Wolfspeed), II-VI, and the production capacity release of China's SAN 'a Photoelectric, Tianke Heda and other enterprises, SiC application is expected to accelerate the popularity, and domestic silicon carbide substrate is expected to occupy half of the country, providing a solid foundation for China's new energy and 5G construction.

Silicon carbide (SiC) substrate is the basis of gallium nitride (GaN) and silicon carbide power devices. Although the scale application of gallium nitride as a substrate still faces challenges, its application in the field of communication radio frequency continues to expand. In contrast, silicon carbide materials are increasingly used in power devices because of their excellent electron mobility and high voltage resistance. Especially in the field of new energy vehicles, charging piles and other new energy, the demand for efficient, high-frequency, high temperature resistant silicon carbide power devices has surged, promoting the rapid development of the industry. In the face of huge market demand, domestic and foreign enterprises have increased investment to expand the production capacity of silicon carbide substrate. International giants such as Wolfspeed and II-VI continue to consolidate their market leadership through capacity expansion and technological innovation. Wolfspeed's Mohawk Valley plant in New York, for example, is already in production and is expected to reach 720,000 tablets per year by 2023-2024.

In addition, domestic enterprises Tianke Heda and Tianyue Advanced are also accelerating the construction of production lines, and it is expected that by the end of 2025, Tianke Heda's 6-inch effective production capacity will reach 550,000 pieces/year. Although international players currently dominate the silicon carbide substrate market, Chinese companies are catching up. In addition to capacity expansion, technological breakthroughs are also key. The epitaxial equipment plays an important role in the preparation of SIC substrate. In the past, this field was mainly monopolized by four leading foreign enterprises.

However, with the breakthrough of Chinese enterprises such as NAult in silicon carbide epitaxial furnace technology, the market share of domestic equipment is expected to increase. Naura's SiC epitaxial furnaces have achieved mass production, and the cumulative number of orders has exceeded 100 units by September 2022; The company has also started the development of epitaxial production equipment and is expected to deliver a prototype for production verification in 2023.

The rapid growth of the silicon carbide substrate market has provided a huge development space for domestic enterprises. With the advancement of technology and the improvement of production capacity, domestic silicon carbide substrate is expected to significantly increase its market share in the next few years, especially in the new energy and 5G construction applications will be more extensive. This will not only help reduce the dependence on external supply chains, but also promote the overall competitiveness of China's semiconductor industry.

The rise of domestic silicon carbide substrate marks a solid step in the field of third-generation semiconductor materials in China. Under the background of increasingly fierce competition in the global silicon carbide substrate market, Chinese enterprises are gradually narrowing the gap with international giants through technological innovation and capacity expansion. It is expected that in the future, with the further reduction of the cost of silicon carbide substrate and the improvement of performance, domestic silicon carbide substrate will play an increasingly important role in the construction of new energy and 5G, and inject new vitality into the development of China's semiconductor industry.

The Products You May Be Interested In

|

CAR2548DCXXXZ01A | DC/DC CONVERTER 48V 2500W | 498 More on Order |

|

AXH010A0YZ | DC DC CONVERTER 1.8V 18W | 202 More on Order |

|

AXH010A0Y93-SR | DC DC CONVERTER 1.8V 18W | 404 More on Order |

|

AXA010A0G93-SRZ | DC DC CONVERTER 2.5V 25W | 481 More on Order |

|

AXA010A0A3Z | DC DC CONVERTER 1.2-5.5V 55W | 355 More on Order |

|

JNCW450R41-18Z | DC DC CONVERTER 32V 450W | 428 More on Order |

|

HW010A0F1-SR | DC DC CONVERTER 3.3V 33W | 358 More on Order |

|

EHHD020A0F41-SZ | DC DC CONVERTER 3.3V 66W | 215 More on Order |

|

EQW010A0B1Z | DC DC CONVERTER 12V 120W | 216 More on Order |

|

EHW007A0B41-HZ | DC DC CONVERTER 12V 84W | 356 More on Order |

|

QRW025A0Y4 | DC DC CONVERTER 1.8V 45W | 431 More on Order |

|

QBK025A0B1 | DC DC CONVERTER 12V 300W | 169 More on Order |

|

LW015B9 | DC DC CONVERTER 12V 15W | 444 More on Order |

|

HW025FG | DC DC CONVERTER 3.3V 2.5V 25W | 241 More on Order |

|

FW250A1 | DC DC CONVERTER 5V 250W | 348 More on Order |

|

ATH010A0X3 | DC DC CONVERTER 0.8-3.6V 36W | 103 More on Order |

|

QBVW033A0B641-HZ | DC DC CONVERTER 12V 400W | 499 More on Order |

|

QBVW025A0B61-HZ | DC DC CONVERTER 12V 300W | 409 More on Order |

|

QBVW025A0B61Z | DC DC CONVERTER 12V 300W | 488 More on Order |

|

ERCW003A6R41Z | DC DC CONVERTER 28V | 145 More on Order |

|

KHHD010A0F41-SRZ | DC DC CONVERTER 3.3V 33W | 291 More on Order |

|

EQW020A0F1Z | DC DC CONVERTER 3.3V 66W | 264 More on Order |

|

PJT020A0X43-SRZ | DC DC CONVERTER 0.51-3.63V | 718 More on Order |

|

AXH005A0XZ | DC DC CONVERTER 0.8-3.6V 18W | 1616 More on Order |

Semiconductors

Semiconductors

Passive Components

Passive Components

Sensors

Sensors

Power

Power

Optoelectronics

Optoelectronics